Given that data and accurate data exchange is crucial in the insurance industry, stakeholders in this sector including insurers, brokers, and general transcription provider providing insurance transcription are evaluating innovative ways in which information can be communicated, managed, used and shared. This becomes especially important with the immense potential being offered by evolving technology, and the changing expectations of insurance buyers regarding the way in which insurance processes are done.

Role of Technology in Enhancing Data Exchange

Technological advancements are transforming the insurance sector by impacting its core systems. The most important requirement is improving data exchange between various entities in the insurance sector, such as brokers and insurers. Insurance brokers can send the applications and requests to insurers via memo or email. Alternatively, they could create brokerage records and then re-enter the same data into the insurers’ systems through various portals and bridges. The method carries the risk of keying errors as well as increased security risks. The issue is more pronounced with regard to existing policies that may need to incorporate the endorsements and changes introduced. Compared to manual transcription and data entry for insurance policies, improved software integration would be beneficial for insurers, brokers and consumers.

Cutting-edge software solutions designed for insurance brokers streamline communication and enhance brokerage operations. These system efficiently manages and tracks all customer communications. By organizing and storing data in suitable formats, it enables swift access, crucial for time-sensitive operations. Advanced software empowers brokers to effectively communicate policy changes, claims updates, and other essential information to insurers and customers alike.

Greater capabilities and connectivity will ensure uninterrupted and accurate exchange of data in the entire insurance life cycle for processes such as quoting, billing, underwriting, claims and other data exchanges. Advanced technology, improved systems, and enhanced insurer-broker relationship will benefit the entire insurance industry by improving efficiency and consumer satisfaction.

Some of the evident changes in the insurance business sector are:

- Connectivity issues are being successfully resolved with new, versatile technology

- XML has been adopted as a common, flexible language; and available speed and capacity through the internet has steadily improved.

- Broker management systems (BMS) are being developed that will eventually be able to employ a uniform process to transmit new business, inquiry and policy change requests directly to multiple insurers and immediately deliver the results to customers.

- There is increased use of the cloud environment now for developing and testing, which is a more flexible method.

- Increased implementation and use of technology would help avoid delays from repetitive data entry, password authentication and batch processes.

- Transactions can be completed with much greater accuracy and speed, and the objective is to enable the majority of transactions to pass through without having to be referred to underwriters.

In this regard, the essential principles for electronic data exchange articulated by the IBAC (Insurance Brokers Association of Canada) are significant. These principles have earned broad acceptance as a frame of reference for integration designs. In the latter half of the year 2015, many insurers implementing one software platform formed a user group, and then a sub-committee to focus specifically on transforming communication to brokers’ systems. A project was started to design and create a software module that could receive standard transaction messages transmitted from brokers’ systems, transmit the data to insurers’ policy installations from that vendor, and send back standard responses to document brokers’ records. The technical design has been completed and early this year, they launched the construction of the first version of the software in a test environment, which is scheduled through to mid-2017. Alongside, a revised standards update has also been introduced, ensuring that the standard on which effective connectivity depends to cover all necessary data is rapidly and regularly refreshed.

Brokers can prepare to optimize the connectivity by reviewing the data processes and QA measures in their brokerage in advance. This is vital because for the new data exchange system to function optimally, the information has to be accurate, clean and complete in the first place.

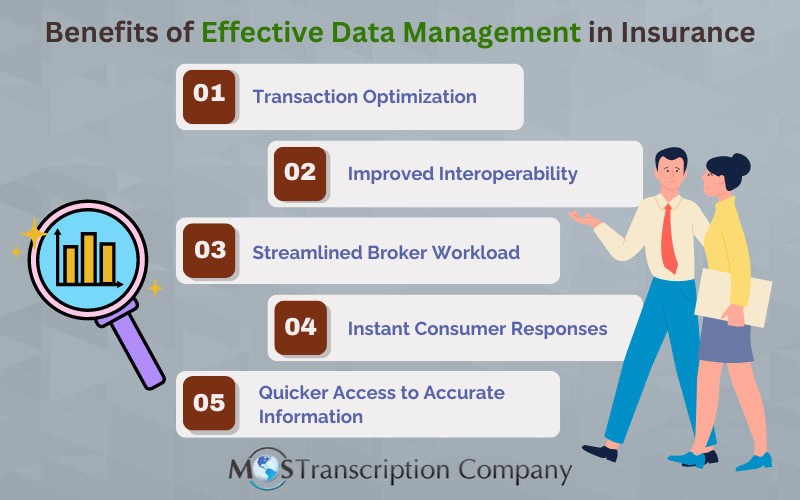

Here are the benefits of a good data management system for the insurance sector:

- There will be more opportunity to optimize insurance transactions, and more ease of doing business for the customer.

- Interoperability will be improved.

- Brokers can eliminate unnecessary work and invest more resources to more meaningful, responsive and customer focused activities.

- Brokers can provide immediate answers to consumers who expect immediate turnaround.

- Customers receive better information more quickly because the data will be more accurate and current.

This connectivity revolution is still in its initial stages and a lot of work remains to be done before the new model can be offered to all players in the industry sector.

How Insurance Transcription Facilitates Better Connectivity

When considering the importance of connectivity in efficient insurance data management, we also need to think of its importance for the insurance transcription sector. High speed connectivity is a major requirement for a transcription service provider to ensure fast data transfer and round-the clock documentation.

Transcription will continue to be necessary in the insurance industry because of the amount of work associated with documenting the increasing volume of claims and compensations. Insurance related documents are numerous – interviews, statements, testimonies, telephone conversations, arbitration proceedings. Recordings related to these will have to be transcribed consistently, which calls for professional support. Take for instance, a case of theft of property. The victim’s initial statement reporting the occurrence of the incident may be recorded and collected as audio files that are later transcribed into text for official use. This is to make it easier for the insurance company assessor to start making any necessary investigations. The insurance assessor may conduct oral interviews with the victim and eye-witnesses, and these are also recorded and later transcribed. In addition, the assessor may create a summary report on the findings in the form of an audio file which would also need to be transcribed.

Let’s look at the role of transcription in fostering communication and connectivity in the insurance sector:

- Accurate capture of dictated records: Insurance transcription services bridge the communication gap by converting spoken communication, such as meetings, calls, and interviews, into written text. This creates a permanent record that can be easily accessed and referred back to, ensuring that important details are accurately captured and shared among stakeholders.

- Supports remote collaboration: In today’s digital landscape, remote collaboration has become increasingly prevalent. Insurance transcription allows for seamless communication and collaboration regardless of geographical locations. Transcribed documents can be easily shared among team members, enabling real-time updates, feedback, and decision-making. This fosters better connectivity among dispersed teams and enhances overall communication efficiency.

- Enhances clarity and understanding: Complex insurance terms, policies, and procedures can often be a challenge to grasp. Insurance transcription services help in clarifying these complexities by converting them into written form. This enhances understanding and ensures that all parties involved have a clear comprehension of insurance-related matters, further strengthening connectivity and reducing misunderstandings.

- Supports compliance and risk management: Accurate documentation is crucial for compliance and risk management in the insurance sector. Transcribed documents serve as legal evidence and support regulatory requirements. Insurance professionals can refer to these transcripts during audits, investigations, or legal proceedings, ensuring compliance with industry standards and regulations. This adherence to compliance fosters trust and transparency among stakeholders, thereby improving connectivity within the industry.

- Streamlines claims processing: Claims processing involves a plethora of documentation and communication. Insurance transcription services streamline this process by accurately transcribing statements, interviews, and reports related to claims. This ensures that all relevant information is captured and managed efficiently throughout the claims processing cycle, leading to improved data management practices.

Read our blog post to learn

Insurance transcription services present a creative and tactical way to handle the wealth of data that goes along with each claim in the quick-changing and fast-paced insurance industry, where accuracy and efficiency are critical. With the thorough collection and transcription of vital information, these services facilitate the smooth processing of claims and are essential in guaranteeing prompt services, assisting with the identification of fraudulent activity, and improving overall connectivity and operational effectiveness. These services enable insurance carriers to optimize their claims management procedures, leading to improved customer experiences and increased organizational performance. This is made possible by their all-inclusive products and dedication to accuracy.

Improve your data management efforts with timely and accurate business transcription services.